Opening SBI Savings Plus Account

Let's Change our existing Normal savings bank account to Savings Plus Account.

Thought of writing something different today. This past week

I was thinking of changing my normal SBI savings bank account to SBI savings plus account and today I implemented my plan. Before discussing the process

involved in changing the normal savings bank account to Savings Plus account,

let me provide my readers with a brief of the savings plus account.

Most of the banks in India (both Government and Private)

offers their customers with a facility where they can earn a higher rate of

interest than the interest provided in a normal savings bank account while

enjoying the liquidity of the normal savings bank account. The facility that is

provided is known as SWEEP FACILITY. What happens in the savings account

offering the sweep facility is that barring a minimum amount the excess

amount becomes a fixed deposit, this in banking terms is known as MOD or Multi

Option Deposit. This feature can be best explained with the help of an example.

Let’s say I have got INR 50,000.00 in my bank account. Now let’s

say it will suffice my wants and needs if I maintain a maximum amount of INR

25,000.00 in my account. So what to do with the excess amount? The answer is

quite simple, I will invest it. How? I can open a FD or invest in MF (Mutual

Funds) or some other kind of investment tools. By investing through these

methods what will happen is that my money will lose its high liquidity

power which I could have enjoyed if my money was lying idle in my savings

account. (Here I would like to mention I am repeatedly using the term liquidity.

For those who are not familiar with this term liquidity, in layman terms it

means you’re the power you possess to withdraw your money when you need it,

i.e. high liquidity means you can withdraw money whenever you wish to and vice

versa). In order to enjoy high liquidity and high rate of interest I

can open a Savings plus account. Here above INR 25,000.00 (Resultant

Balance) the excess money will form a fixed deposit known as MOD. A minimum

of INR 10,000.00 above the resultant balance is needed to form a MOD, i.e. a

MOD will be formed when I have a balance of at least INR 35,000.00 (Threshold

Balance) in my account. So here I have INR 50,000.00 in my account which

means a MOD of INR 25,000.00 will be formed. Every time the balance in my

account goes above the threshold balance, then that amount minus 25K will form

a new FD. The maturity period of these FD(s) are usually 1 year and they enjoy

the same rate of interest as normal FD(s).

Steps to change normal savings bank account to Savings

Plus account in SBI.

1. You need to have

Internet Banking associated with your account.

2. Open www.onlinesbi.com

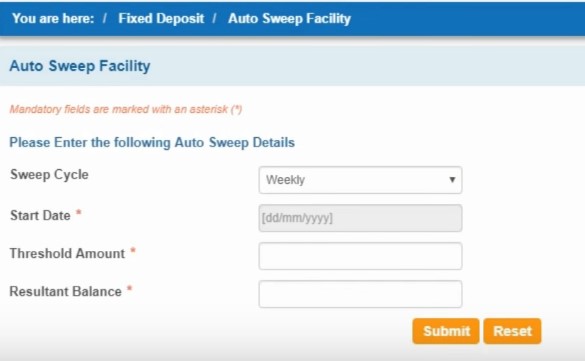

4. Go to Fixed Deposit on the top menu

5. Click on Auto Sweep Facility

6. Select the savings account you want to change.

7. Click on continue.

8. You will be receiving a SMS containing an OTP.

9. Enter the OTP in the field mentioned as High Security

Password and click continue.

10. Select the Sweep cycle. You can either choose Weekly (here SBI will check every week whether your threshold limit has reached) or Monthly.

11. Select the date when you want SBI to check whether the

threshold limit has reached or not.

12. Provide the Threshold limit (minimum INR 35K)

13. Provide the Resultant Amount (minimum INR 25K)

14. Click on Submit.

15. A successful message will be shown (Your account has been successfully converted from SB to SB Plus.)

Eureka!! You have a Savings Plus Account now in SBI.

16. Now check on the date provided whether the excess amount

(min. INR 10K) has been converted to a FD or not

Remember the interest earned is taxable, so do not forget

to submit 15G or 15H (whichever is applicable for you)

Keep earning.

Comments

Post a Comment